About FCTI

FCTI, Inc. is an established nationwide ATM and financial technology solutions provider specializing in advanced ATM placements, operations, and advertising for banks, credit unions, consumer brands, and retail establishments.

INTRODUCTION

In an era where digital transformation is pivotal, Financial & Technology Crossover Inc. (FCTI), a leading ATM operator, faced significant challenges in managing cash flow across its vast network of terminals. Aryng, a data science consulting firm, was tasked with overhauling FCTI's cash forecasting model to enhance accuracy, efficiency, and financial outcomes. This case study delves into the problems FCTI encountered, Aryng's AI and ML-driven solutions, the methodology employed, and the profound impact of this partnership.

PROBLEMS

FCTI's existing model was plagued with inaccuracies and inefficiencies, primarily due to:

- Inadequate Forecasting Accuracy: Inaccurate error calculation masked the gravity of cash shortages, leading to discrepancies between predicted and actual cash withdrawals.

- Obsolete Success Metrics: The model failed to consider the financial impact of inaccuracies, crucial for addressing cash runouts and optimizing operational costs.

- Limited Data Utilization: Misalignment between model training and prediction phases led to unreliable forecasts, compounded by the absence of a historical data analysis framework.

HEAR FROM FCTI

SOLUTION

Aryng’s strategy to revitalize FCTI’s cash management system hinged on a dual approach: enhancing predictive accuracy through forecasting and refining operational decision-making with an optimizer.

- Optimized Business Goals: Redefined success metrics to emphasize the financial impact of forecasting errors and focused on terminals with significant dollar impacts.

- Advanced Forecasting AI Tools: Tested various AI and ML algorithms and identified FBProphet as the most effective algorithm to reduce MAPE. We then fine tuned the model with hyper parameter training and parameters optimization improving overall accuracy and operational implementation.

- Balanced Optimizer: Developed a linear model that integrated multiple factors such as cash forecast data, interest rates, historical penalties, and out-of-cash occurrences to create an optimized cash loading plan for each terminal.

METHODOLOGY

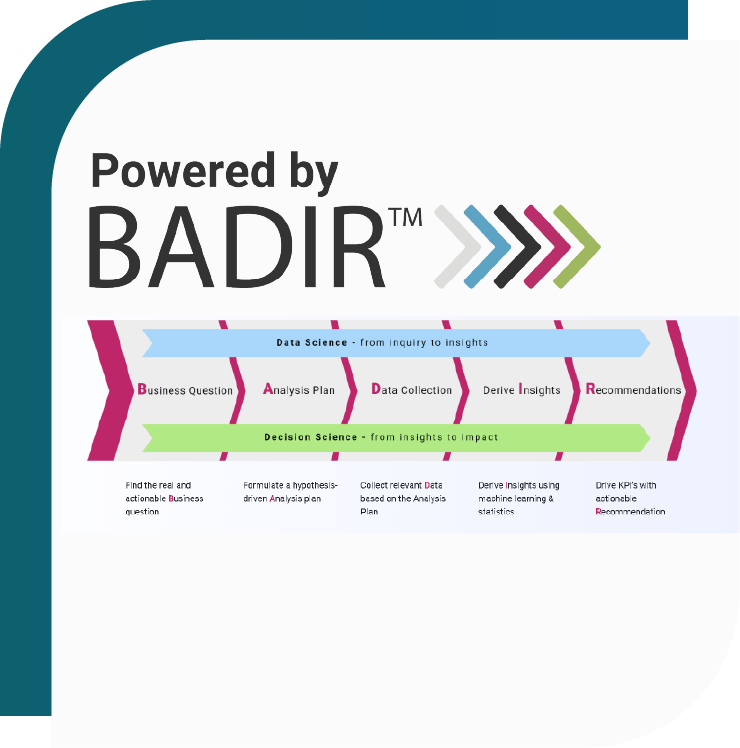

Aryng's approach leveraged the BADIR™ framework, ensuring a data-driven and hypothesis-led strategy:

- Business Question: Began with a thorough analysis of FCTI's current model and its shortcomings in meeting financial and operational goals.

- Analysis Plan: Conducted a detailed examination of the model's performance, highlighting areas for improvement in prediction accuracy and financial impact, and formulating a plan for the future dual model.

- Data Collection: Utilized a larger dataset incorporating advanced time series features and historical data analysis.

- Insights: Calibrated the ML algorithms within FBProphet to align closely with the training and prediction phases, significantly reducing prediction errors. The optimizer then produced a final multiplier to adjust the cash forecast, minimizing total cash usage, out-of-cash incidences, and residual rates, thereby cutting overall costs and enhancing customer SLA.

- Recommendations: Encoded the final models in the database and implemented a series of ML-centric operational improvements, including updating business goals and enhancing data utilization for ongoing model refinement.

RESULTS

6%

Superior Forecasting Accuracy: The forecasting brought a new level of precision to cash demand predictions, reducing MAPE by 6% point and significantly reducing instances of cash shortages or excesses.

10%

Financial Optimization: The synergy between the forecaster and optimizer allowed for a holistic view of cash management, blending accurate demand forecasting with strategic operational decisions to cut costs by 10%.

Enhanced Operational Efficiency: The new state-of-the-art forecasting system equipped with auto retraining continues to reduce cash needed and improve error rates without human intervention, enabling a more adaptable and precise cash management approach and optimizing operational decisions.

IMPACT

The impact of Aryng's intervention was substantial, offering FCTI a competitive edge through:

- Cost Reduction: Enhanced accuracy and efficiency in cash management led to significant savings in operational costs, including reduced penalties for cash shortages and optimized cash loading schedules.

- Revenue Enhancement: Improved cash availability ensured a better customer experience, leading to increased transactions and revenue for FCTI.

CONCLUSION

Aryng's strategic overhaul of FCTI's cash management, blending predictive accuracy in forecasting with strategic optimization in operations, showcases a forward-thinking methodology for effectively addressing traditional cash management hurdles.

Seek a fresh perspective on your Data Science models?

Aryng offers a complimentary 1-hour consultation to review your models and discuss innovative solutions. Plus, we're eager to delve deeper into our methodology — email datascience@aryng.com for an exclusive copy of our whitepaper.